Today’s Fed announcement – what it means for gold

From: GoldSilver.com May-17-2021 02:42:am![]()

So far 2022 has given investors a never-ending buffet of risks: markets are volatile, war in Ukraine rages on, and inflation continues to send the prices of everything soaring higher.

But there is a silver (and gold) lining to it all…

Periods of high inflation can be an opportunity for gold and silver investors.

![]()

And inflation doesn’t look to be letting up anytime soon.

Federal Reserve Chairman, Jerome Powell, admitted this trend is likely to continue, “we’re going to see upward pressure on inflation, at least for a while…”

The current rate of inflation is 7.9%, the highest in four decades.

“People are getting worried about inflation continuing to rise,” reports Forbes.

And according to a Bankrate survey, 26% of Americans believe their financial situation will be worse in 2022, and of those 70% blame inflation.

Which is why the Fed is under increasing pressure to fight inflation…

Today, the central bank is expected to announce an interest rate hike and the end of its massive bond buying program.In other words, to dampen inflation, the Fed is reducing its support for the US economy and asset prices.

But this is only the beginning of a tightening cycle the likes of which we haven’t seen since the late 1970s, a time of extraordinary gains for precious metals.

Are we on the cusp of another bull market for gold and silver?

Well, a word of caution, metal prices actually tend to fall at the initial hike.Already, gold is trading lower this week as we enter a period of seasonal weakness for the yellow metal.

This could be a possible “buy the dip” opportunity.

As gold historically rises during rate-hike periods:

![]()

Which is why demand for gold may be rising, in fact:

• Comex gold deliveries in 2021 were more than triple the 15-year average.

• U.S. Mint gold coin sales hit their highest level, over 1.25 million ounces, the most since 2009.

• In China, retail gold sales have rebounded, with the strongest sales surprisingly coming from 20- and 30-year olds.

• And in India, gold imports hit a record $55.7 billion in 2021, surpassing 2019’s high and more than double 2020.

• Meanwhile, central banks continue to buy gold with global reserves now at a 31-year high.

Short-term demand for precious metals appears to be building, possibly setting up further price appreciation…

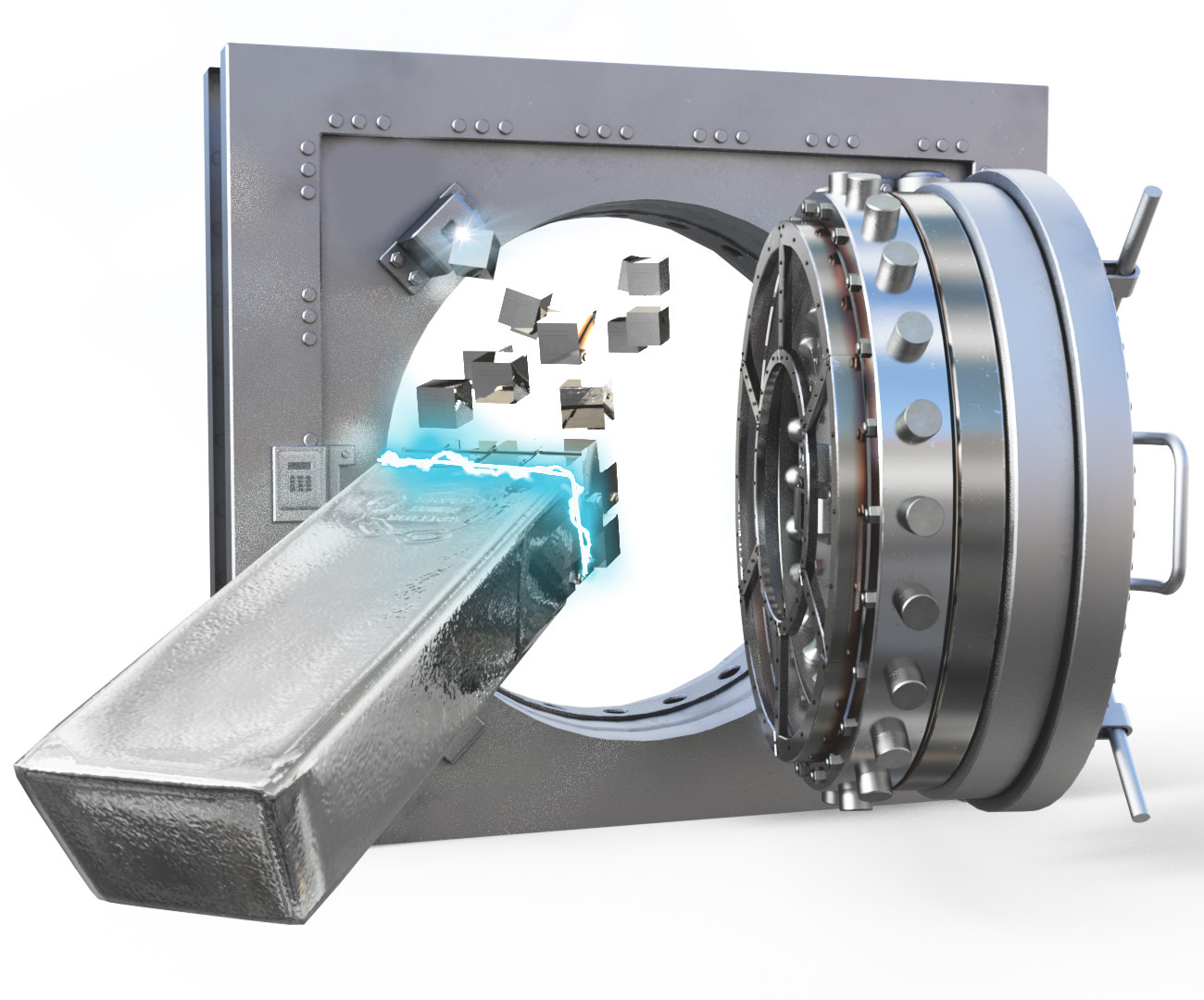

But the real reason to hold physical gold and silver is to preserve your purchasing power over time. Gold is a store of value, not a trade.

Gold can retain value when inflation eats away at savings accounts and increases living expenses.

And at GoldSilver.com, we make it easy to put the power of gold to work for you.

You can buy in increments in as little as 1/100th a troy ounce and enjoy immediate liquidity with InstaVault Gold.

Or shop for popular bars and coins for home delivery or private vault storage with the full confidence of our price match guarantee.

And we're with you every step of the way. If you have questions or need assistance give our friendly client team a call at 1-888-319-8166 or reply to this email and we’ll get in touch.

Shop for Precious Metals Now Top-selling Gold & Silver This Week

*Prices as of email send date & time.

You’re receiving this message because you’re a valued GoldSilver.com customer or you signed up to receive emails from us.

If you no longer want to receive updates on major market moves, newsletters, or occasional notifications of discounts or new products, update your preferences to choose the types of emails you want to receive or unsubscribe.

© 2022 GoldSilver LLC

750 Third Avenue, Suite 702

New York, NY 10017

1-888-319-8166

![]()

GoldSilver.com

GoldSilver.com Email Offers

- 📩 This Is HUGE. Something REALLY Important Is Happening in the Gold Market RIGHT NOW

- 📩 8 Reasons the Dollar Gets Knocked Out by Gold

- 📩 The Greatest Theft in Human History?

- 📩 📺 Banking Contagion - What Next? Plus Q&A with Mike

- 📩 Price Alert 🚨 Silver is down -4%

- 📩 Buying an RV With Gold Coins

- 📩 Price Alert: Silver is up 8.65%

- 📩 ALERT: 8 Reasons Stocks, Real Estate & Bonds Will Crater Like it's 1929 (New Book Preview)

- 📩 Super-Strong US Dollar Is De-Stabilizing All Other Fiat Currencies - When Will It End? | Gordon Long

- 📩 ALERT: The ALMOST Everything Bubble Set to Explode

- 📩 SILVER ALERT: Boring...Boring...BOOM!

- 📩 Will it really happen for silver?

- 📩 Weekly Market Recap: “Pain” Ahead As Fed Dashes Pivot Hopes While Tightening Into Recession

- 📩 Seats filling up fast – former insider reveals Fed's next moves

- 📩 A Restrictive Fed Has Changed EVERYTHING For The Markets | Sven Henrich

- 📩 Invitation to my upcoming appearance

- 📩 Weekly Market Recap: Are The Bulls Gaining The Upper Hand?

- 📩 How China Could Trigger Recession Into a Full-Blown Depression

- 📩 Decoding the Recession Double-Speak

- 📩 Silver and gold’s historical correlations to high inflation

- 📩 The 'Great Reset' IS The Death of the Global Dollar Standard

- 📩 Weekly Market Recap: Disappointing Earnings Forecast To Tank Stocks?

- 📩 Price Alert: Silver falls below $20/oz, a two-year low

- 📩 ALERT: Only 3 of 20 Rate Hikes DIDN'T End in Recession

- 📩 Gold Is Doing Its Job

- 📩 Weekly Market Recap: Sell Into This Week's Strength? Probably A Good Idea

- 📩 Mike Maloney - signs the Fed is going to break the economy

- 📩 SPECIAL REPORT: Inflation...THEN DEFLATION

- 📩 Weekly Market Recap: Will The Beatings Stop? Or Are Markets Headed Even Lower?

- 📩 Can you weather the coming Economic Hurricane? View All Email Offers >>

GoldSilver.com Promo Codes

Popular Stores

- Environmental Toothbrush

- Foo Fighters

- Gizmogul

- X22report

- Baabaazuzu

- Chrisanne Clover

- Ludlam Dramatics

- Rohner Socks

- WAGs

- Life Of Pix

- Unlocking Online

- Fogg Couture

- RF Parts Company

- Right Channel Radios

- Craft Clarity

- iRingPro

- Century Health Nutrition

- Cleverfit

- Happy State

- TheClip.com

- Tanstartrade

- White Claw

- MANCAN Wine

- Slow & Low

- FreeFoodPhotos

- On The Rocks Cocktails

- Ever Skin

- M2 Antenna Systems

- Good Stock Photos

- Picography